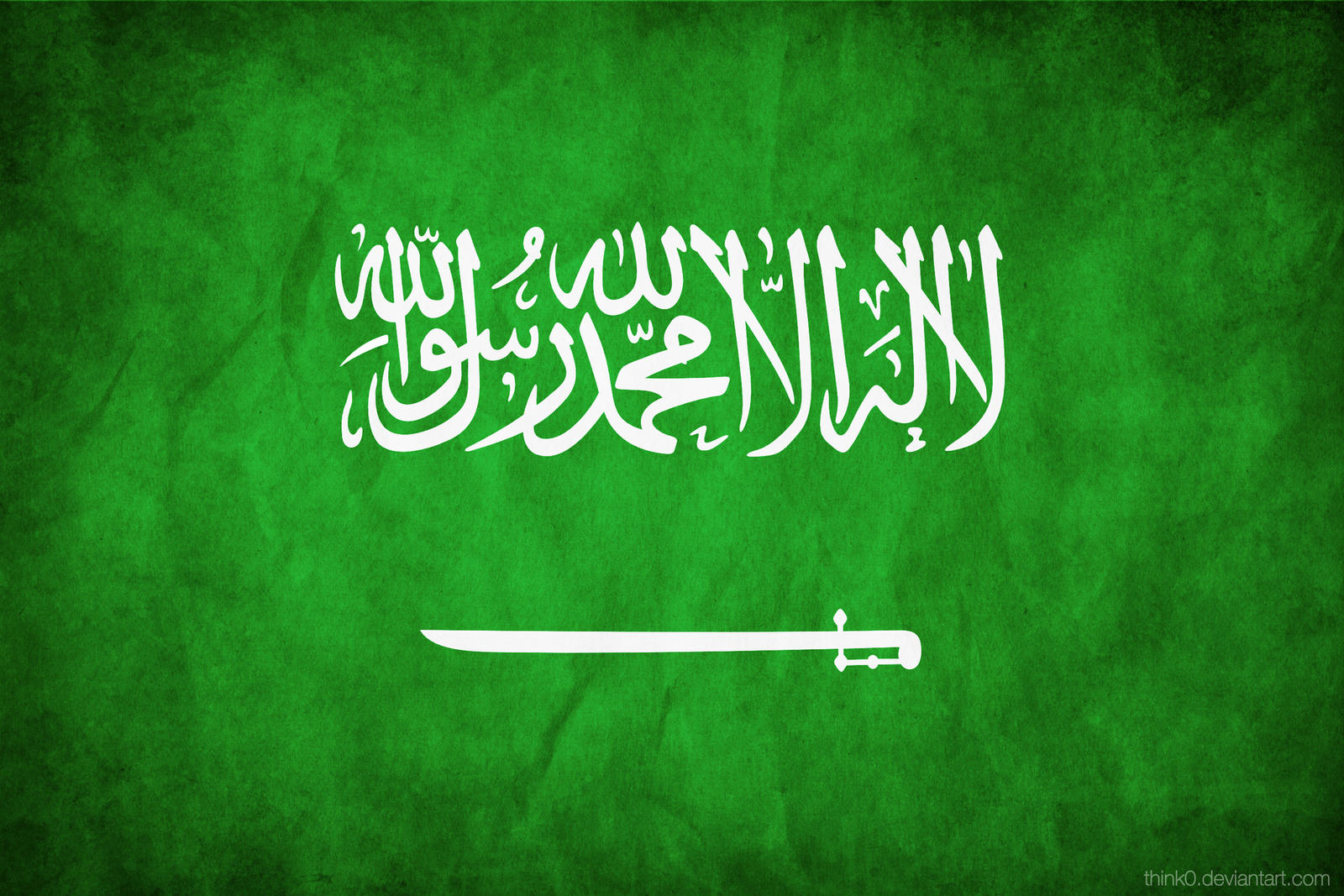

A 50-year-old US-Saudi Petrodollar Agreement recently expired and Riyadh has opted not to renew it. The shift of base currency marks a significant departure from the longstanding financial arrangement between both countries, originally established in 1974.

That used to be a period marked by the aftermath of the Arab oil embargo and a notable spike in international oil rates. The agreement sought to establish a stabilised global oil market and ensure a steady flow of oil from Saudi Arabia to the US.

Under the pact, Saudi Arabia agreed to price its oil exports exclusively in US dollars and invest its surplus oil revenues in US Treasury bonds. In return, the US agreed to help the Gulf state with US military, security and economic development assistance.

Almost all OPEC countries use US dollar for oil trading

The petrodollar system replaced gold as the standard of value, enabling the US to maintain dominance over international trade and energy market. Although the Saudi government signed the pact, almost all OPEC countries use the US dollar to sell their oil.

The NY Times described the agreement at the time of its signing as a “milestone pact” and highlighted its role in fostering closer economic relations between the US and Saudi Arabia. The report point about the deal’s potential power to stabilise the oil market.

Over the years, the petrodollar system highly influenced the global economic dynamics as it continued to create a constant demand for US dollars. The value of the US dollar increased and the pact reinforced the currency status as the primary reserve currency of the world.

Flexibility to conduct oil sales in multiple currencies

Saudi Arabia’s recent decision to not renew the agreement gives the Gulf state flexibility to conduct sales of its largest asset in multiple currencies. The Saudi government can enable transactions in the Chinese RMB, Euros, Yen and Yuan, among others.

The decision reflects a broader strategy of the Middle Eastern nation to diversify its economic alliances and reduce its dependency on the US dollar. The move is likely to push other countries to shift away from the US dollar as the primary reserve currency.

So far, the US dollar has served as the base for determining the value of different international currencies. But that connection is highly likely to change in the coming years, according to experts. Even digital currencies like Bitcoin could be used for future oil trading.